In many ways, Tesla is unlike other car companies. It's not just that they aren't saddled with a legacy combustion business; there are EV start-ups like Lucid and Rivian that are similar in this respect. So what is it that makes Tesla different?

We've previously written about some of these differences here (Tesla's moats) and here (Tesla is far more than a car company.) These moats certainly are important; however, this entry is not going to repeat those. Rather, this entry is about an additional advantage, one that isn't structural, and perhaps it's their biggest advantage.

|

| A Matryoshka of Tesla Superchargers |

Tesla was founded in 2003 (almost 20 years ago). Prototypes of their first car (Tesla Roadster) were officially revealed on July 19, 2006, during an invitation-only event at the Santa Monica Airport.

Unknown Unknows

While creating Roadster, they ran into problems. Problems that they didn't even know existed until they tried to make something. The battery pack didn't fit into the existing Elise design. The motors controllers from ACP were hand-tuned analog devices; fine for a prototype, but not consistent nor scalable. Another unforeseen problem, there were no existing transmissions that could handle the torque that these powerful motors delivered.Tip of the Spear :: The Earliest Early Adopters

The Benefit of Time and Iteration

When you are trying to solve a big problem (such as how to make a fast, affordable, long-range EV) you run into a lot of smaller problems along the way. The problems often have layers and you must keep "peeling the onion" to solve them. It's a recursive nest of problems until you finally solve a fundamental issue, solving this allows you to pop-the-stack; reversing back up the layers, unwinding the problems of each layer with solutions from the layer below.

|

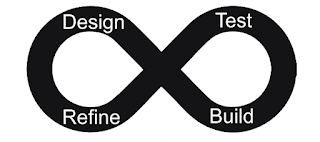

| Innovation Flywheel |

The faster that you can move around this loop, the faster your products improve. Tesla does not restrain themselves to 'model years' because this slows down their innovation time. Instead, the vehicles have detailed computer models that let employees test things out in virtual space first. If the computer models show that this would be a better product (better range, performance, cost, build time...) then it is prototyped and tested. A small change could go from idea to rolling out the door in new cars later the same day.

As changes are made, the software in the car is updated to recognize this change and self-test this new functionality as each car rolls off the line. Each car is its own unit test system. This helps ensure quality and it allows the cars to self-diagnose issues when service is scheduled. This built-in self-test provides a safety net for innovation. If a change introduces an unexpected second-order effect, one of the thousands of self-tests can catch it before the vehicle goes out the door.

Now Versus Then

Tesla has had the advantage of time. They've had more than a decade of runaway to make mistakes. The 2012 Model S won Car of the Year when it came out. If a startup were to release a car like that today, it would be panned as slow, short-ranged, inadequately thermally managed..., compared to the Model S of today.

Tesla's biggest advantage is that they didn't have to compete with anyone else that was a pure-play EV manufacturer for the first decade and a half of their existence. Or said another way: Tesla's biggest advantage is that during their stumbling, skinned knees, learning, ramp-up mode, they didn't have to compete with, well, Tesla.

Tesla's biggest advantage is that they didn't have to compete with Tesla.New Start-Ups Have A Bigger Challenge

2012 Model S compared to 2022 Model S

|

| 2012 Tesla Model S |

|

| 2022 Tesla Model S |

| Model S | 2012 85 RWD |

2022 Long Range Dual Motor |

|---|---|---|

| Price (Long Range) | $115,050 | $99,990* |

| Price (inflation adj.) | $144,069 | $99,990 |

| Range (miles) | 265 | 375 |

| 0-60 | 4.3 sec | 3.1 sec |

| Autopilot/FSD | None - no cameras (AP was intro-ed in 2014) |

AP standard, FSD Upgrade $12,000 |

| Supercharging Rate (kW) |

90 (5 miles/minute max) |

250 (11 miles/minute max) |

| Gaming | Chess, Backgammon, a few 80s arcade games |

Equivalent to modern game console, Steam client support planned |

Something is a bit odd still, as it seems one can only comment as anonymous. Attempting to use your Google account causes the page to reload and you are allowed to post as...anonymous.

ReplyDeleteOddity aside, I tend to agree that Tesla has had a wonderful bit of runway so to speak while traditional automakers decided where they stand on the electrification front and the Lucids, Rivians, etc. of the world went through the various growing pains of bringing factories and vehicles to production and then trying to scale up said production.

As it relates to the cost of the Model S today, while I fully agree that the equipment that you receive today vs back in 2012 is vastly improved, I am not as convinced that there is quite as much savings. As of today, the Tesla price quote includes an $8400 "savings" based upon 6 years of gasoline purchases. If you look at the actual price you would pay at checkout, the price is ~$112K give or take and depending on options. I of course made the sensible choice of dropping the silly 21" wheels and went with the 19" and saved over $4000, and received another 15 miles of range!

Quips aside, it seems to me that Tesla is still largely enjoying the fact that they are the only player in the game. They are clearly spending a lot of money expanding capacity in various geos. I would tend to argue that the price of the car itself has been fairly flat - shady "You save this much!" factored into the cost shown to you is not my idea of cool.

As you have noted in previous posts, I think true competition in the EV space is when we will start to see downward pressure on the price of the vehicle proper. The competitors in the ~$100Kish car space is increasing. I have no data on how saturated this market space is, but I think between the VW group, Lucid, the Mercedes-Benz Group and others we will be finding out sooner than later.

The action seems to be in the Model Y space, where Tesla is rumored to be enjoying the savings allowed by the Gigapress and the 4680 cell. However, the price of a 2022 Model Y is up over the 2021 model significantly. I am curious to understand the specifics around this more, but if one were to simply look at the "price of a new car" $62,900 is a tough entry point for a large number of people.

But back to the article, again, I agree that the "What you get" between 2012 and 2021 is incredible. I tend to feel that a significant amount of any savings Tesla is seeing is going more towards expansion, which is likely a good idea for them as people are still buying their vehicles by the boatloads, and expanding their capabilities means they will stay in their leadership space for longer. I know we like to chuckle at the legacy automakers, but I strongly feel that a couple of those dinosaurs are going to make a very strong push into Tesla's space and they will be forced to say "Game on!" - then the customer will really win!

Thanks for the detailed comment. I have fixed the anonymous comment issue. I was trying to block spam comments and I was trying to block anonymous comments (not force comments to be anonymous). The settings are now corrected.

Delete